Interest for students

Anyone who has a grant, loan, student travel product or lifelong learning credit will accrue student debt from the 1st month. Interest is calculated on this debt. This means the debt increases.

The government determines how high this interest is. This is the interest rate. While you are pursuing your studies, the interest rate is always fixed for 1 year. This means it can be higher one year and lower the next, or it may stay the same. The interest rate will be announced every year in October.

Which interest rate applies to you?

The interest rates are linked to the repayment rules that apply to you. Most current students fall under the SF35 repayment rules. The applicable rate in 2026 is 2.33%.

A smaller number of students fall under SF15. The interest rate for 2026 is 2.29% (2.21% in 2025). Right now, the interest rate for this group is set at 2.95%. For more information on the repayment rules that apply to you, go to Mijn DUO.

Log in op Mijn DUOLog in op Mijn DUO

Overview interest rates

| Year | Interest rate(%) |

|---|---|

| 2026 | 2,33 (SF35) en 2,29 (SF15) |

| 2025 | 2,57 (SF35) en 2,21 (SF15) |

| 2024 | 2,56 (SF35) en 2,95 (SF15) |

| 2023 | 0,46 (SF35) en 1,78 (SF15) |

| 2022 | 0,00 |

| 2021 | 0,00 |

| 2020 | 0,00 |

| 2019 | 0,00 |

| 2018 | 0,00 |

| 2017 | 0,00 |

| 2016 | 0,01 |

| 2015 | 0,12 |

| 2014 | 0,81 |

| 2013 | 0,60 |

| 2012 | 1,39 |

| 2011 | 1,50 |

| 2010 | 2,39 |

| 2009 | 3,58 |

| 2008 | 4,17 |

| 2007 | 3,70 |

| 2006 | 2,74 |

Interest for lifelong learning credit

You are required to repay a lifelong learning credit in no more than 15 years. The interest rate is equal to the interest rate of SF35.

How interest works

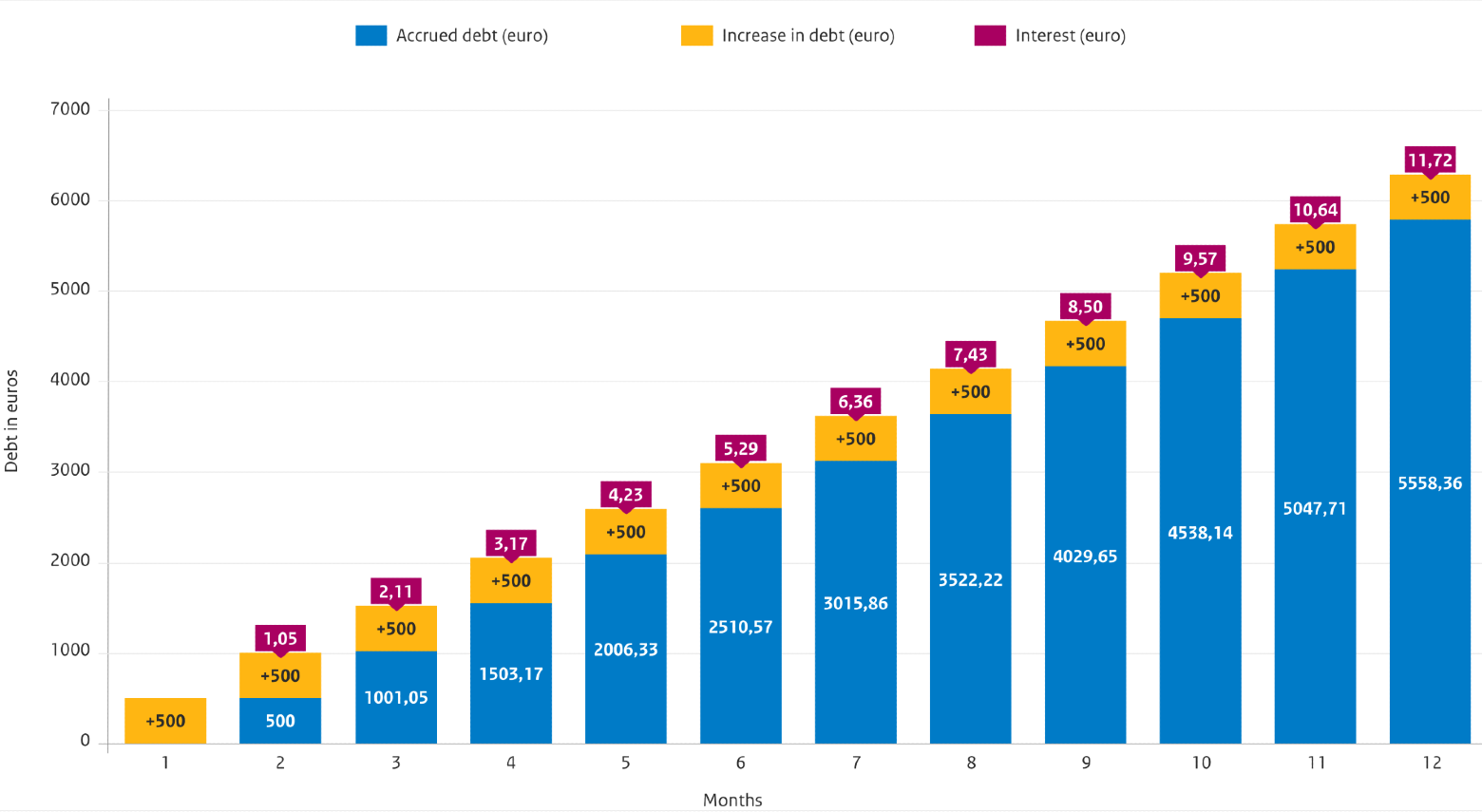

The interest is calculated month by month on your total student debt, which is the amount of your debt plus any interest that has already accrued. Interest is also calculated on interest. This is referred to as ‘compound interest’.

Example

The example chart shows how this works for a loan in the amount of €500. The interest will be calculated from the month following payment. The number of days on which interest is calculated is always 30, even if a month does not have 30 days. The amounts in the example have been rounded up or down. In this example, €70.08 in interest was added in one year, namely all interest amounts per month added together.

Calculate your interest

Interest after obtaining your diploma

Are you obtaining your diploma? Then your performance-related grant (basic grant, supplementary grant and student travel product) will be converted into a gift, including the interest accrued.

FAQs

I would like to pay off (part of) my loan now. How do I do that?

You can always begin paying off your debt (or part thereof) in Mijn DUO, even if you are not yet required to begin paying back your loan.

- Log in to Mijn DUO.

- Go to ‘Mijn schulden’ and choose ‘Meer betalen’.

- Pay off an amount via iDEAL by clicking the button ‘Extra aflossen’.

Log in to Mijn DUOLog in to Mijn DUO

If you have several debts with various interest rates, we will always deduct any additional payments from the debt with the highest interest rate.

Would you like to write off a debt for which the interest rate is being increased? Transfer the desired amount as explained above. Please contact our customer service once the payment has been debited. The employee can then debit the payment from the debt you wish to repay.

Are you unable to log in to Mijn DUO? And would you like to pay off something other than a loan? Find out which reference you should use in that case.

How can I keep my interest as low as possible?

If you are able to spare the money, you can choose to repay part of your performance-related grant now. Your debt will then be lower, so you will pay less interest in total. You will then have to pay back less of your performance-related grant if you do not obtain your diploma on time. This is because the interest will then be calculated on a smaller amount.

Have you obtained your diploma on time? Then the part of the performance-related grant that has been repaid will be transferred back into your bank account.

How is the interest rate determined?

The interest rate depends on the repayment rules. Under the repayment rules of SF15, the repayment period is 15 years, and under S35 it is 35 years.

The interest is calculated as follows:

- The interest rate under the SF15 repayment rules depends on the average interest on the 3-year to 5-year bonds in the month of September, which is to say interest due for that month alone.

- The interest rate under the SF35 repayment rules depends on the average interest on the 5-year bonds from previous year's October to the end of September of the current year, which is to say a period of 12 months.