Do you have a performance-related grant or a loan? If so, then that will be subject to interest. Since January 2023, the interest rate has been higher than 0 for the first time in a long while. In 2024, the interest rate has been increased again.

What is the interest rate?

The interest rate depends on the repayment rules that apply to you. Whether you are required to pay back, depends on whether you obtain your diploma and take out a loan or not. In Mijn DUO, under ‘Mijn Schulden’, you can check which repayment rules apply to you and what portion is performance-based grant.

To see your interest rate and for how long it is fixed, log in to Mijn DUO and look at Mijn Schulden.

SF15 repayment rules:

- You have have 15 years to repay your loan.

- In 2025, the interest for these loans is 2.21%.

SF35 repayment rules:

- You have 35 years to repay your loan.

- In 2025, the interest for these loans is 2.57%.

I am no longer studying

Are you already repaying your student debt? If so, the interest rate will increase only if your new fixed-rate period starts in 2024. If you last received student finance in 2023, the new percentage applies from 2024 for a period of 5 years.

You'll receive a notice about your interest rate and monthly payments in November. Check the options to pay less or pay more.

Why the interest has changed

The interest rate depends on the repayment rules, because repayment periods differ. Under the SF15 repayment rules, a student debt must be repaid within 15 years. Under the SF35 repayment rules, this period is 35 years.

The interest is calculated as follows:

- Under the SF15 repayment rules, the interest rate depends on the average yield of 3-year to 5-year bonds in September. In other words, the yield for that month alone.

- Under the SF35 repayment rules, the interest rate depends on the average yield of 5-year bonds from the start of October to the end of September the following year. In other words, a period of 12 months.

The average interest rate over a period of 12 months may differ from the interest rate in September alone. Hence the percentages may differ.

Who sets the interest rate?

Each year, the Ministry of Education, Culture and Science (OCW) sets the interest rate charged on student loans. That interest rate is linked to the interest rate that the government pays for loans on the capital market. These are referred to as government bonds. In recent years, the interest rate on government bonds has been very low. This has been reflected by the interest rate on student loans. Interest rates are now rising again, due to inflation. As a result, the state now has to pay more for its loans. This, in turn, has pushed up the interest on student loans.

How interest works for students

You start to accrue student debt from your 1st month of a performance-related grant or loan. That debt is then subject to interest. The government sets the applicable percentage of interest. This is referred to as the ‘interest rate’. While you are pursuing your studies, the interest rate is always fixed for 1 year. This means it can be higher one year and lower the next, or it may stay the same.

The interest is added every month. The interest is calculated based on your total student debt at that time. That is the amount of your debt plus any interest that has already accrued. So you are paying interest on interest. This is referred to as ‘compound interest’.

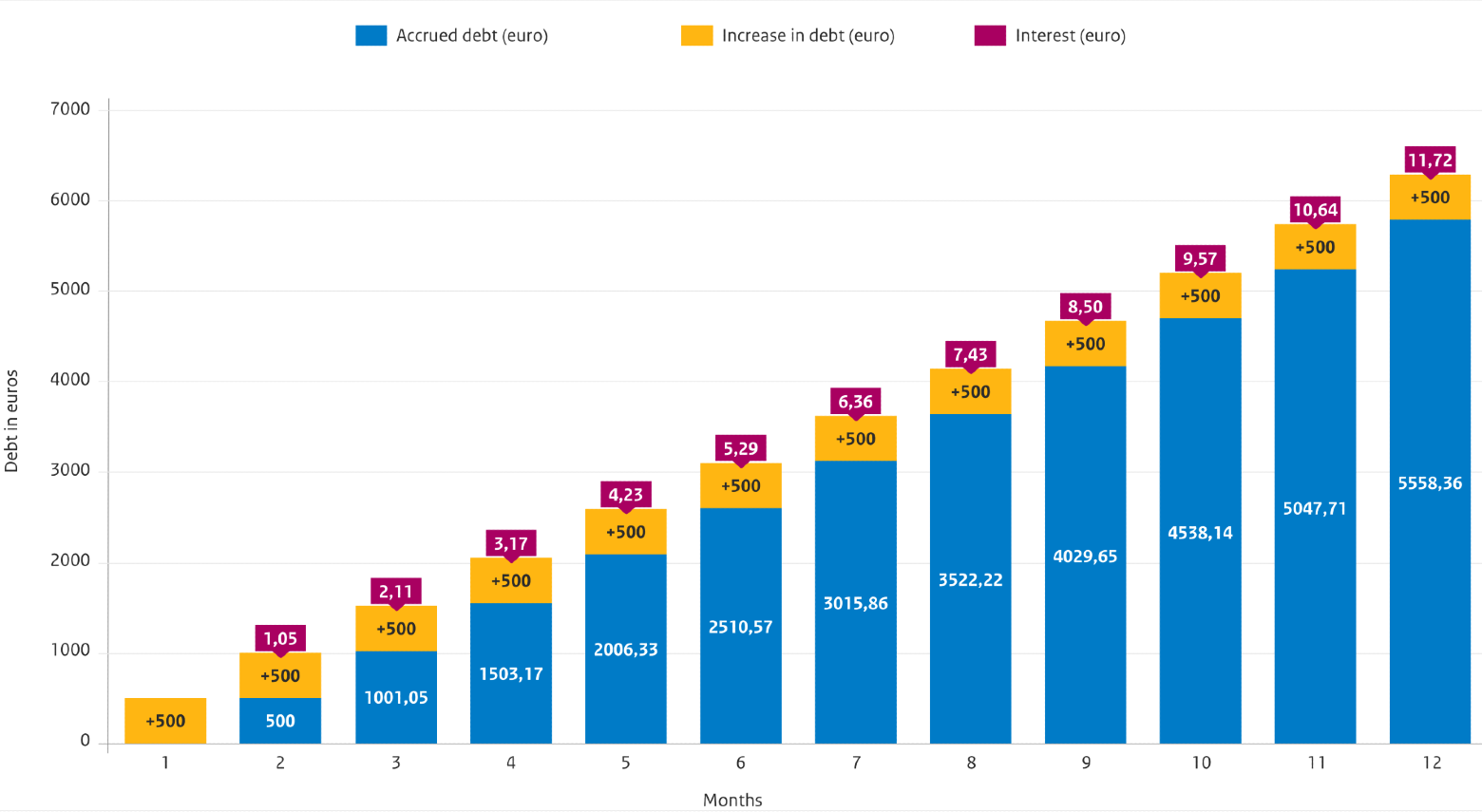

In the sample chart, you can see how this works for a loan of €500. Interest is calculated from the month following the disbursement. The number of days for interest calculation is always 30, even if a month has fewer or more than 30 days. The amounts in the example are rounded.

If you obtain a diploma, your performance-related grant is converted into a gift, including any interest.

Can I fix the new percentage for a longer period?

The interest rate is determined annually for one year during your studies. Therefore, a different percentage will apply from 2025. You can fix the new percentage from 2024 for 5 years. This applies only to the student debt you have accumulated until 2023.

- You will stop receiving your student finance from January 1, 2024. You had until January 1, 2024, to do this.

- The debt you have accrued so far during the transitional period will be subject to the interest rate fixed for 5 years from 2024. This applies even if the percentage decreases in 2025.

- During the month of January, you will be without student finance and can't travel using your student travel product.

- From February 1, you can reapply for student finance. If you are 30 years or older at that time, you will no longer be eligible for student finance.

I want to (partially) repay my loan, how do I do that?

Do you not see an iDeal button in My DUO? You can then make (additional) repayments by transferring an amount to us yourself to account number: NL45 INGB 0705 0019 03. In the name of: Dienst Uitvoering Onderwijs, Groningen, Netherlands. Use your citizen service number with the addition 'ILS' as a description. Example: 123466789ILS. This addition ensures the correct processing of your payment.

See which attribute you should use. See also the page about Repaying your debt.

Interest rates in recent years

| Year | Interest rate (%) |

|---|---|

| 2025 | 2.57 (SF35) and 2.21 (SF15) |

| 2024 | 2.56 (SF35) and 2.95 (SF15) |

| 2023 | 0.46 (SF35) and 1.78 (SF15) |

| 2022 | 0.00 |

| 2021 | 0.00 |

| 2020 | 0.00 |

| 2019 | 0.00 |

| 2018 | 0.00 |

| 2017 | 0.00 |

| 2016 | 0.01 |

| 2015 | 0.12 |

| 2014 | 0.81 |

| 2013 | 0.60 |

| 2012 | 1.39 |

| 2011 | 1.50 |

| 2010 | 2.39 |

| 2009 | 3.58 |

| 2008 | 4.17 |

| 2007 | 3.70 |

| 2006 | 2.74 |

How interest works when repaying a student debt

Have you completed your studies and now need to repay your student debt? If so, the interest rate is always fixed for 5 years, from the start of your preliminary phase. This is referred to as the ‘fixed-rate period’. You will then pay the same interest rate for 5 years. The interest rate will subsequently be reset, once again for 5 years. Check Mijn DUO for details of your current interest rate and its period of validity.

The interest on your total residual debt is calculated month by month. That is the amount of your debt plus any interest that has already accrued. So you are paying interest on interest. This is referred to as ‘compound interest’.

Examples fixed-rate period

Example 1

Saskia graduated from her secondary vocational education (MBO) programme in 2018. She has taken out a loan, so she has a student debt. As a result, her preliminary phase commenced with effect from 2019.

- The interest rate for 2019 was 0.00%. This rate was fixed for a period of 5 years. This means that, from the start of January 2019 to the end of December 2023, Saskia will pay no interest on her student debt.

- In January 2024, Saskia will commence a new fixed-rate period. At that point in time, the interest rate will be 2.95%. Thus, commencing in 2024, Saskia will pay 2.95% interest on her debt. Once again, this will apply for a period of 5 years, up to the end of December 2028.

- In 2029, Saskia's next fixed-rate period will commence. For the following 5 years she will be subject to the 2029 interest rate.

Example 2

Anton discontinued his studies in 2015, without obtaining a diploma. He has a student debt. As a result, his preliminary phase commenced with effect from 2016.

- The interest rate for 2016 was 0.01%. This rate was fixed for a period of 5 years. This means that, from the start of January 2016 to the end of December 2020, Anton paid 0.01% interest on his student debt.

- In January 2021, Anton commenced a new fixed-rate period. At that point in time, the interest rate was 0.00%. Thus, since 2021, Anton has paid no interest on his debt. Once again, this applies for a period of 5 years, up to the end of December 2025.

- In 2026, Anton will commence the next fixed-rate period. For the following 5 years he will be subject to the 2026 interest rate.

What to do if you have a student debt

Every year in November you will receive a message about your interest rate and the amount of your monthly repayments.

- What if the amount of your monthly repayments increases and you are unable to pay? You could, perhaps, be granted a reduced monthly repayment, or you could temporarily repay less or nothing at all.

- You can also pay off your student debt earlier or make an extra payment. Your debt will then be lower, so you will pay less interest in total.